Written by: cs361

Compilation: Deep Tide TechFlow

The innovation of AMM has contributed to the explosive growth of the DeFi industry, which has grown from $500 million in the last cycle to just under $20 billion today, an astonishing increase of almost 400 times.

What if I told you we were on the brink of another innovation that could have a similar impact? This article will introduce you to this groundbreaking innovation - unsecured lending towards efficiency.

Credit markets are key to stimulating economic growth and are a central part of an efficient economic system. At TradFi, secured loans and unsecured loans.

A secured loan requires a collateralized asset, such as a house, car or stock, with a loan-to-value ratio of about 110%. Since the counterparty risk is minimal, these are low-risk chips.

Unsecured loans have higher interest rates and are only backed by credit scores.

While secured lending is already an integral part of DeFi (despite higher lending rates), the absence of unsecured lending is a huge bottleneck. Why is it so difficult to bring such a century-old tool on-chain?

credit default

In the traditional world, there are professionals who come to "know you" and deal with credit issues, but this goes against the automation, transparency, and non-discrimination of DeFi.

speed reduction

Any kind of additional checks on borrowers can significantly slow loan approval times. Current overcollateralized lending services offer extremely fast loan approvals, a unique selling point for DeFi.

less liquidity/flexibility

Most borrowers are only interested in predictable fixed-rate and term loans. But in this highly active market, few people lock up their assets for long periods of time.

Regulatory risk

Providing unsecured loans will bring regulators to the attention of providing these loan agreements because the 2008 financial crisis left PTSD.

Loan Specific Risks

• Real-world assets and NFT lending - asset liquidity;

• Credit score - scarce on-chain data, anyone can make unlimited wallets;

• Off-chain credit integration - relies on TradFi infrastructure;

......

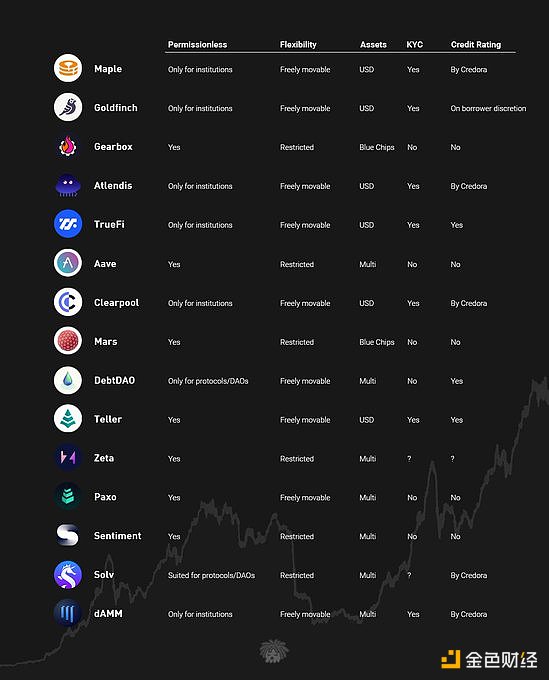

Despite the risks and challenges, there are many agreements that provide undersecured loans in some form.

As with most problems, there are multiple potential solutions. Let's take a look at the most promising paths, and which problems they solve and which ones don't.

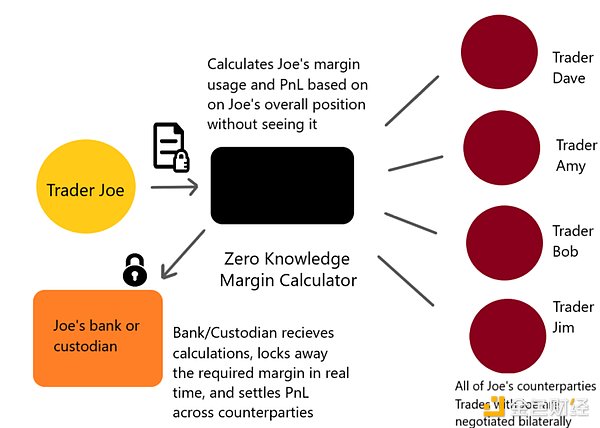

1. zkKYC

Using zero-knowledge proof KYC in know-your-customer, it is possible to know the customer without pre-sharing personal information with the counterparty. Lenders are able to verify the creditworthiness of borrowers through the proof of validity on the issued zkKYC tokens.

Credora Platform leverages this technology to achieve efficiency through disintermediation. It changes the traditional clearing structure by providing a ZK margin calculator that sends margin and settlement instructions to the custodian.

This implementation of zkKYC is not decentralized but focused on the institutional market. However, there are some benefits to staying centralized, and it's still a big improvement over the usual clearing system.

2. Debt tokenization

Debt is tokenized to make it fungible and thus free up lenders’ capital by participating in transactions. This might also address maturity mismatches and allow for segmentation, increasing the number of possible investors/lenders.

ERC-20 tokens, which represent debts owed by institutions, are ideal investment vehicles for private investors looking for a safe return, and in the case of zero-interest bonds, debt tokens appreciate in value until maturity.

3. Proxy account

This solution is best suited for unsecured loans to retail investors and does not require KYC. The borrower deposits the collateral and obtains the agent smart contract through the loan.

The funds are controlled by the borrower, but since the correspondent account is restricted on certain protocols and no withdrawals are allowed, it is impossible to run away with the money. Proxy accounts enforce trust at the code level by restricting functionality.

All in all, the most promising all-around solution is zkKYC, as it provides a way for institutions and private participants to obtain loans.

The best way for investors to make money on a loan is to buy tokenized debt at a discount and wait for it to mature or sell it early. Retail investors can borrow funds using proxy accounts and use leverage to interact with the largest protocols. On GearboxProtocol, these protocols include Curve, Uniswap, Sushi, and Yearn.

There are also some solutions:

-

Contract-to-contract lending - mostly untapped: flash loans (non-traditional lending);

-

(Social) Default Recovery Fund - Guaranteed repayment with a multi-signature fund;

-

Native token incentives;

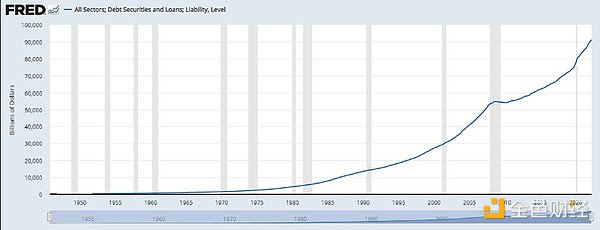

Creating a safe and efficient debt issuance infrastructure will attract sticky capital to the market as part of the $70 trillion global lending market mobile chain.

I don't think true decentralization will win here, as legacy companies need to have a regulatory framework in place to make this transition. It will be interesting to see how this sector develops going forward as more protocols experiment with unique loan issuances.

In the end, my conclusion is:

Unsecured lending is leveraged . They led to the 2008 financial crisis that pushed the global economy to the brink of collapse.

So, if we get it right, it will cement DeFi's place in this economy, but if we get it wrong, we face serious regulation until it disappears.

source: https://www.jinse.com/blockchain/2350736.html